Step-by-Step Guide: How to Form an LLC and Protect Your Business

Starting a business is an exciting endeavor, but it’s also filled with decisions and paperwork that can feel overwhelming. One of the first choices you’ll need to make is deciding which type of business structure works best for your goals. For many entrepreneurs, forming a Limited Liability Company (LLC) is a popular option. Why? Because an LLC offers a perfect blend of legal protection, tax flexibility, and operational simplicity. This step-by-step guide will take you through everything you need to know about forming an LLC and protecting your business. Whether you’re a seasoned entrepreneur or just starting, the process is easier than it sounds, and with the right information, you can get your LLC up and running smoothly.

What is an LLC and Why is It Important for Entrepreneurs?

An LLC, or Limited Liability Company, is a legal business structure that combines the benefits of both a corporation and a partnership or sole proprietorship. It protects your personal assets from business debts and liabilities, which is crucial for entrepreneurs who don’t want to risk their home, car, or personal savings in case the business faces financial trouble.

One of the primary advantages of forming an LLC is the protection it provides. If your business gets sued or incurs debts, your personal assets are generally safe. This is known as “limited liability,” which is a key difference from sole proprietorships and partnerships, where personal assets can be at risk. LLCs are also incredibly flexible when it comes to management and taxation, offering various options to fit the needs of any entrepreneur.

If you’re wondering whether forming an LLC is the right choice for you, it’s crucial to weigh the pros and cons in relation to your business goals. However, as we dive deeper into the process of setting up your LLC, you’ll see why many entrepreneurs prefer this structure.

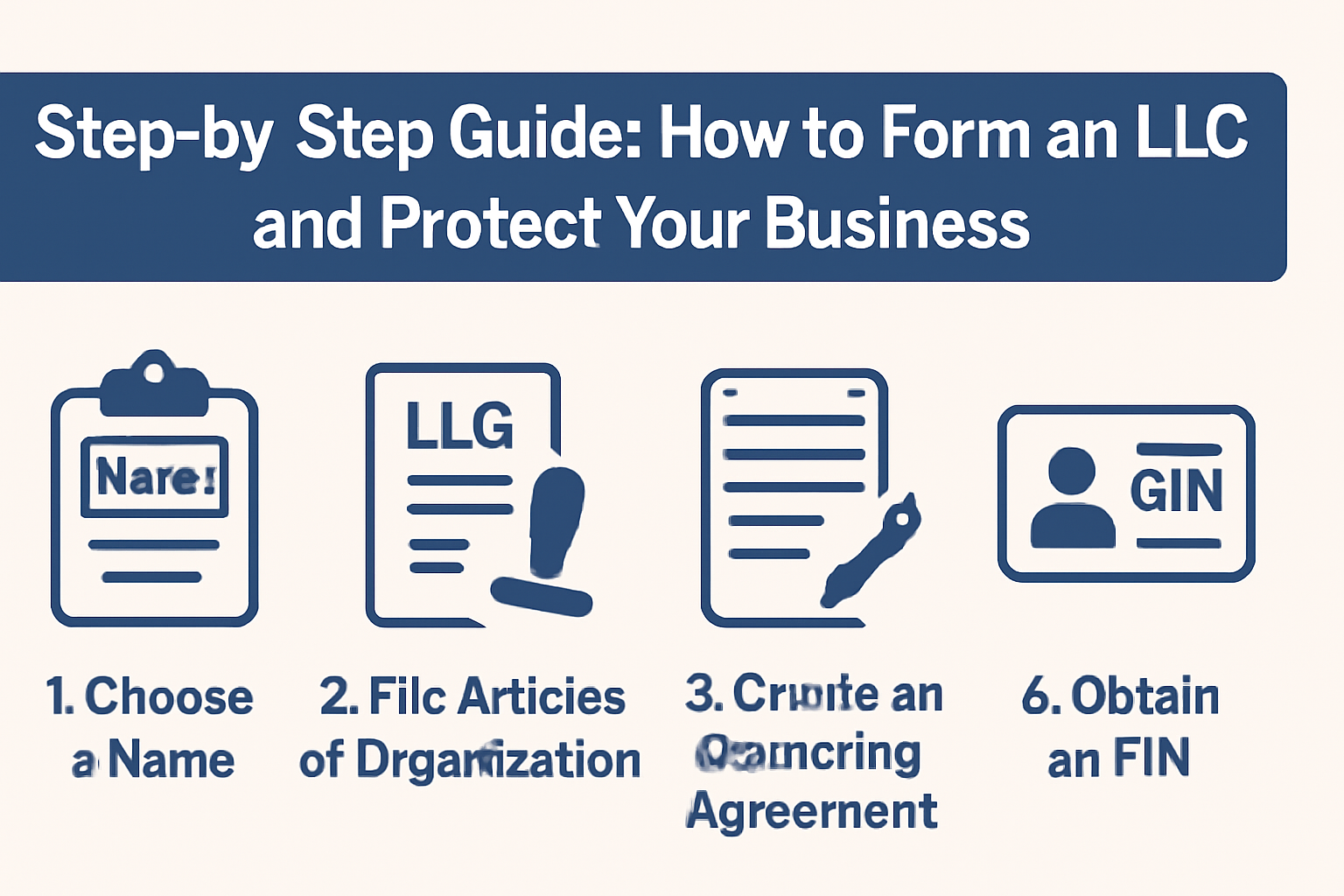

How to Form an LLC: Step-by-Step

Now that you understand the importance of an LLC, it’s time to get into the details of how to form one. The process might seem like a lot of work upfront, but breaking it down into manageable steps will make it much more approachable. Here’s a detailed guide on how to form an LLC:

1. Choose Your LLC Name

The first step in forming your LLC is selecting a name. Your business name needs to be unique, memorable, and reflect the nature of your business. Most importantly, it has to comply with your state’s rules for LLC names. Generally, your LLC name must include “Limited Liability Company” or an abbreviation like “LLC” or “L.L.C.” You’ll also want to check if the name is already in use or trademarked by another business. Many states allow you to check name availability through their online databases.

Before finalizing your choice, make sure your business name isn’t too similar to existing businesses, as this could lead to confusion or legal complications down the line.

2. Select Your Registered Agent

A registered agent is an individual or company designated to receive official documents, legal notices, and service of process on behalf of your LLC. This person or entity must be located in the state where you’re forming your LLC, and they must be available during business hours to receive correspondence.

While you can act as your own registered agent, many entrepreneurs choose to hire a professional registered agent service to ensure that important legal documents don’t get missed. This can be especially helpful if you plan to operate in multiple states or don’t have a physical office.

3. File Articles of Organization

The next step in the process is filing the Articles of Organization, also known as the Certificate of Formation or Certificate of Organization, depending on your state. This document is typically filed with the Secretary of State’s office and includes basic information about your LLC, such as its name, address, registered agent, and purpose.

This document is relatively straightforward, but be sure to provide accurate information to avoid any delays or rejections. There is usually a filing fee involved, which can range from $50 to $500 depending on your state.

If you’re unsure of what to include, you can always seek guidance on how to form an LLC to ensure the process goes smoothly.

Small Biz Pulse is the definitive resource platform for the inspired entrepreneur and the dynamic small business. Their dedication is to empower small businesses and entrepreneurs by providing actionable insights and in-depth resources on various business structures, from Limited Liability Companies (LLCs) to C-Corporations. Every entrepreneur deserves to have access to the most reliable and comprehensive information to make sound business decisions. For more detailed resources and expert guidance on forming your LLC, visit https://smallbizpulse.com/ to get started on your entrepreneurial journey.

4. Create an Operating Agreement

While an operating agreement is not always required by the state, it is highly recommended for LLCs, especially those with more than one member. This document outlines how your LLC will operate, including the ownership percentages, roles and responsibilities, profit-sharing, and dispute resolution methods.

Even if you’re the only member of the LLC, having an operating agreement in place helps solidify your business structure and adds an extra layer of protection for your personal assets. It clarifies expectations and can help avoid confusion in the future.

5. Obtain an EIN (Employer Identification Number)

An Employer Identification Number (EIN) is like a Social Security number for your business. It is required by the IRS for tax purposes and is necessary if you plan to hire employees, open a business bank account, or file taxes as a corporation.

Obtaining an EIN is free and can be done quickly online through the IRS website. You’ll need to provide some basic information about your LLC, such as the name and the address. Once obtained, you’ll use the EIN for tax filings and other business-related activities.

6. Comply with State and Local Licensing Requirements

Depending on the nature of your business and where you operate, you may need to obtain additional permits or licenses to legally operate. These can range from state-level business licenses to local zoning permits and health department inspections. Research your local area’s requirements to ensure that you’re in full compliance with all applicable laws.

7. File Annual Reports and Pay Fees

Many states require LLCs to file annual reports or updates to maintain good standing. These reports typically include basic information about your LLC and must be submitted by a specific deadline each year. Some states also impose annual fees for LLCs, which can range from $50 to $500 or more.

Failure to file your annual reports or pay the necessary fees can result in your LLC being dissolved or losing its status as a legal entity. Keep track of deadlines and maintain compliance to avoid complications.

Benefits of Forming an LLC

As you can see, forming an LLC is a relatively simple process, and the benefits far outweigh the initial effort. Here are just a few of the reasons why entrepreneurs should consider forming an LLC:

- Limited Liability Protection: The most significant advantage of forming an LLC is the protection of your personal assets. Your LLC provides a shield against personal liability, so if your business gets sued or goes into debt, your home, car, and personal savings are protected.

- Tax Flexibility: LLCs offer a variety of tax options. By default, LLCs are taxed as pass-through entities, meaning the business’s profits and losses pass through to the members’ personal tax returns. However, you can also elect to have your LLC taxed as an S-corp or C-corp, depending on your business’s needs.

- Management Flexibility: Unlike corporations, which have strict management structures, LLCs provide flexibility. Members can manage the business themselves or appoint managers to handle day-to-day operations.

- Easy to Maintain: Compared to other business structures, LLCs are easy to maintain. The filing requirements are minimal, and most states do not require regular board meetings or formal records.

Final Thoughts

Forming an LLC is one of the best ways to protect yourself and your business as you grow. It’s a smart choice for entrepreneurs who want the flexibility to operate without the formalities of a corporation, while still enjoying legal protection and tax benefits. By following the steps outlined in this guide, you’ll be well on your way to forming a successful LLC that safeguards your personal assets and supports your business goals.

For more detailed information and resources on forming an LLC and protecting your business, visit Small Biz Pulse. They offer valuable insights and step-by-step guides to ensure you make the best decisions for your business.